The Importance of Diversification

Diversification can be very simple and at the same time very complex to understand. It can have a big impact on a portfolio to reduce risk whilst not eliminating completely.

This insight attempts to answer the following questions: -

What is portfolio diversification?

Why should you diversify?

Why diversification is important?

How diversification works?

What are the benefits of diversification?

How diversification reduces risk?

Can diversification reduce all risk?

The underlying principle of allocating to different regions/sectors/countries is diversification which helps to reduce risk to your portfolio. It simply means not putting all the eggs in one basket. From an investment perspective, it means investing in assets which have different non-similar risk and return characteristics.

It is important to understand that a relatively high risk investment on its own may be suitable in the context of an investor's risk and return objective and aiming to achieve total diversification may not yield the desired benefits. It is therefore important to factor in the overall picture of the investor's circumstances when selecting investments for a diversified portfolio.

How diversification helps in risk management?

In a well diversified portfolio, a single unfavourable scenario may only affect part instead of the entire portfolio. This is because only certain investments may have a bigger negative impact than other investments. Furthermore, some investments could give positive returns in an unfavourable scenario depending on how closely are they related to other investments within a portfolio.

How to diversify your investments?

Diversification is achieved when investments which have different risk return characteristics are added to a portfolio. In other words, you will increase diversification to your portfolio if you add an investment which is less than perfectly correlated to other investments in your portfolio. This can be either in the form of a traditional investment like stock or a bond; or more complex forms like derivatives.

How diversification affects investments

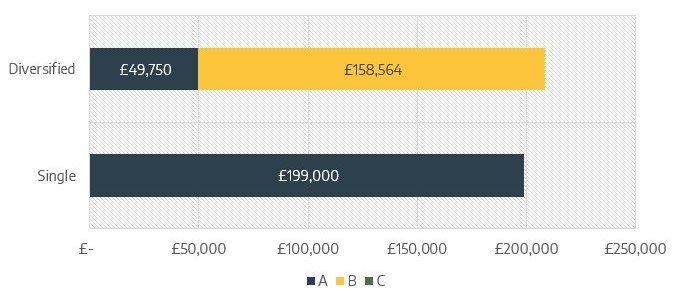

Let us consider two examples of a portfolio of £100,000 with and without diversification. Please note that this is an example for illustrative purposes only and is not representative of any specific investment or a combination of investments. It is also important to note that the example below uses before-tax nominal growth rate.

We start with a diversified portfolio with £100,000 invested across all investments A, B and C within it. The undiversified portfolio contains only investment A for the full amount of £100,000.

Investing £100,000

Assuming a 3.50% annual nominal return on investment A, 6.50% annual nominal return on B and further assuming investment C turns out to be a total loss and is therefore worth nothing at the end of 20 years: -

Investing £100,000 after 20 years

In this example, the diversified portfolio has performed slightly better by assuming lower risks due to diversification.

Diversification does not eliminate risk. It is a strategy to distribute risks of different assets classes which perform differently to each other under different market conditions.

Please note all figures used above are hypothetical and for illustration purposes only and not based on actual returns; the actual return rate may vary.

How to diversify investments?

Some of the ways in which you could have a portfolio diversified are by: -

- Asset Class (Stocks, Bonds, Commodities, Real Estate, Private Equity)

- Geographic (North America, Developed Europe, Emerging Markets, Asia Pacific)

- Sector (Financials, Energy, Materials, Healthcare)

- Country (United States, Spain, Brazil, Japan)

- Size (Large, Small, Blend)