What is a Multi-Asset Class Portfolio?

A multi-asset class that combines exposure to different asset classes in a single portfolio. The resultant portfolio is expected to generate returns based on its risk profile.

And within each asset class, you could have different types of investments which exhibit same risk-return characteristics.

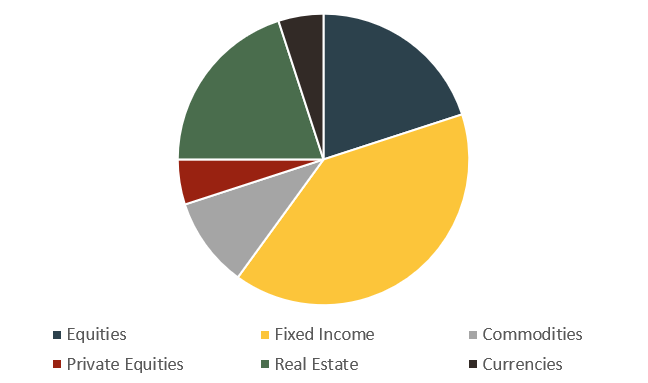

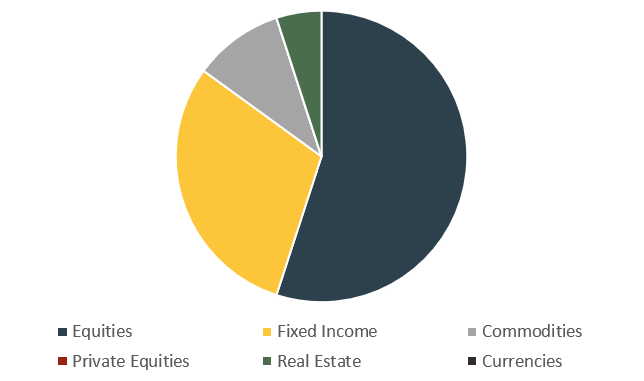

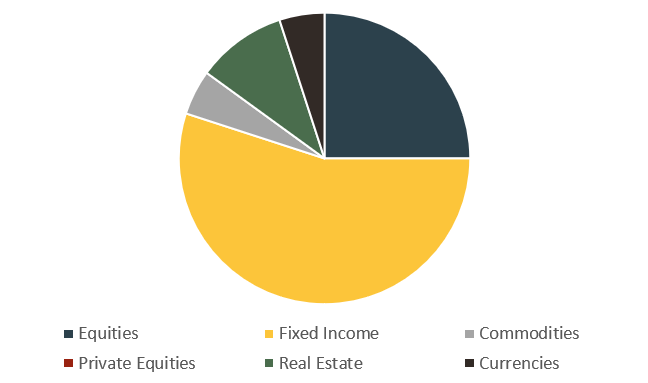

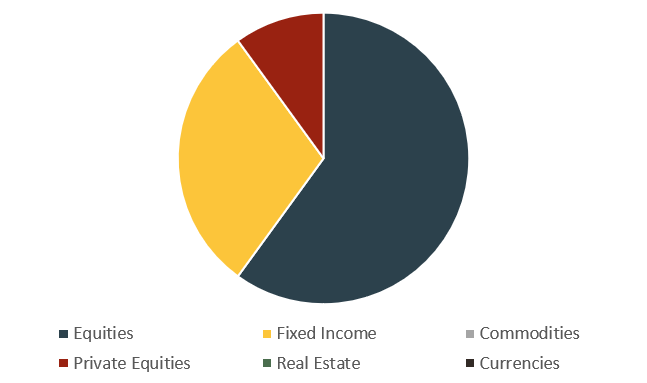

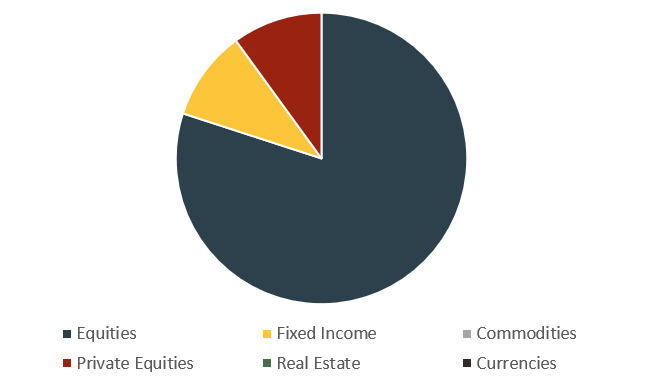

A high-risk portfolio

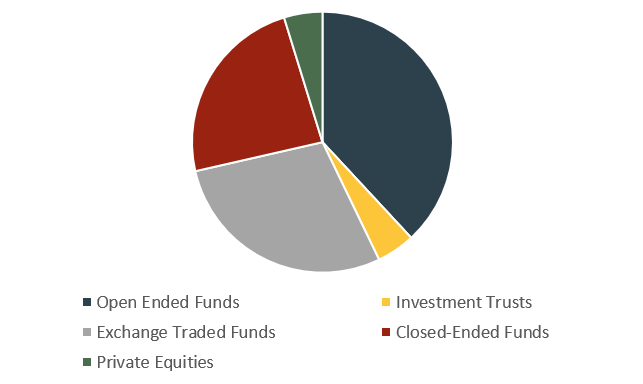

Distribution of investment types within equities

The performance of your investments is subject to risk(s). Its performance may fluctuate based on movements in the market and economic condition(s). Capital at risk. Currency movements may also affect the value of investments. You may get back less than you originally invested. Tax treatment is based on individual's unique circumstances. Past performance is not a reliable indicator of the future performance.

What is ESG Investing?

ESG stands for Environmental, Social, and Governance. Clients are increasingly aware and concerned about these non financial factors in their investment portfolios. Researching and analysing these factors which contribute and affect risk-return profile of an investment due to Environmental, Social, and Governance issues have therefore become even more important. Constructing a portfolio that manages ESG risks is an ongoing challenge as investments continually exhibit changing risk levels to these factors.

Environmental

Concerns about the environment and its preservation

Social

Concerns about managing relationships with stakeholders

Governance

Concerns about governance issues to improve company standards

Every bespoke portfolio at Sevenaar

Risk managed

Your portfolio is constructed based on your risk-profile.

Diversified

Your portfolio has a mix of asset classes that distribute risks appropriately.

Optimised

Your portfolio is constructed using simulation techniques resulting in an optimum level of risk-adjusted expected returns.