4 Types of Income Investing Strategies

Having decent level of savings is important for your future and your loved ones. However, with low interest savings rates, investing is a better option to generate a level of income can not only support your current lifestyle but also build on top of your savings.

This insight attempts to answer the following questions: -

How to get income from investments?

What are the benefits of income investing?

What are the types of income investing strategies?

What is tax free income investing?

At its basic, income investing means, structuring your investments in a way to generate a steady stream of income. For some investments types, the level of income is not guaranteed because they are based on market conditions.

When you invest in equities for the purposes of income, you invest in companies which have a track record of paying back to the shareholders in the form of dividends or share buybacks. It is important to note that the level of dividends fluctuate based on market conditions and on some ocassions, companies may not choose to pay out dividends to preserve cash.

Dividends are currently taxable over £2,000. This limit does not apply when they are received in a tax efficient wrapper like ISA. Dividends from equities in some cases is tax deducted at source.

REITs are companies which own income producing properties and are a great way to generate a fairly steady stream of income over long term. They aim to selectively develop, invest, improve or redevelop properties with a view to generate regular cash flows and distribute this back to its investors.

Dividends are currently taxable over £2,000. This limit does not apply when they are received in a tax efficient wrapper like ISA.

More on REITsThese funds pay a regular stream of dividends (typically quarterly). The original investment fluctuates based on market movements and the fund pays out a regular dividend as cash which you can withdraw when needed.

Dividends are currently taxable over £2,000. This limit does not apply when they are received in a tax efficient wrapper like ISA.

These are investments where you loan your money to the issuer of the bond. Bonds typically have a coupon rate which indicates the amount of income you can expect and its frequency. Note that there are some bonds which do not have any coupon payments.

Interest income is added to your annual income and is taxed at your marginal tax rate. This does not apply when they are received in a tax efficient wrapper like ISA.

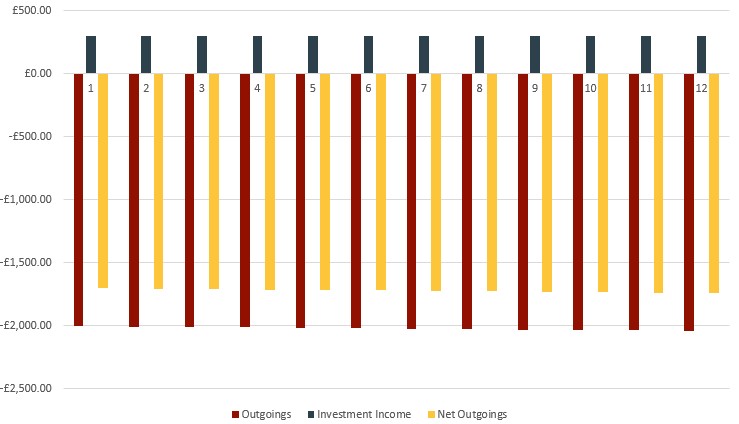

How can income from investing help in outgoings?

Tax free income investing

The annual Individual Savings Account (ISA) allowance for this tax year is upto £20,000. It is important to make use of your full ISA allowance to maximise tax efficiency. Income and dividends received from investments held in ISA are tax free as per current tax laws and you do not need to report it in your tax return.