4 ways to protect your savings from inflation

To first understand what are the possible ways to protect your savings from inflation, let us first understand what inflation does to your savings

This insight attempts to answer the following questions: -

What is inflation?

How does inflation erode savings?

How does inflation affect savings?

What happens to savings during inflation?

How to protect your savings from inflation?

What is the impact of inflation on savings?

Inflation is a measure of overall increases in prices of products and services over time. A higher inflation means you are paying more than you were in the past for the same product or service.

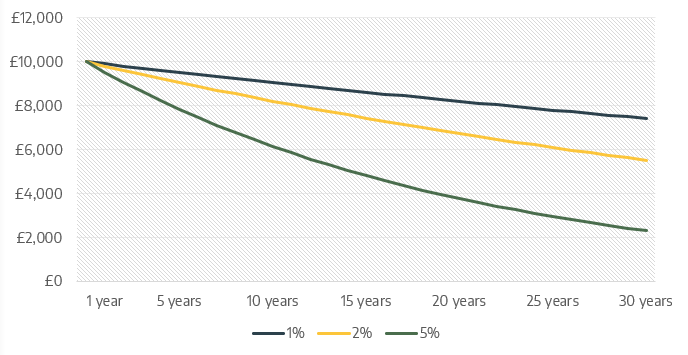

When you put money aside in an account which gives sub-inflation returns, you are essentially losing money in real terms. In other words, higher inflation will erode purchasing power and will make your money buy lesser than what it used to. For example, a 2% inflation over a 10-year period will mean that sum of £10,000 will buy you what £8,203 would buy you today. It is therefore prudent to weigh in your options and consider inflation when making any savings or investment decisions.

The chart below shows the effect of inflation on purchasing power of £10,000. Inflation figures of 1%, 2% and 5% are used to show the effect of different rates.

Effect of inflation on purchasing power

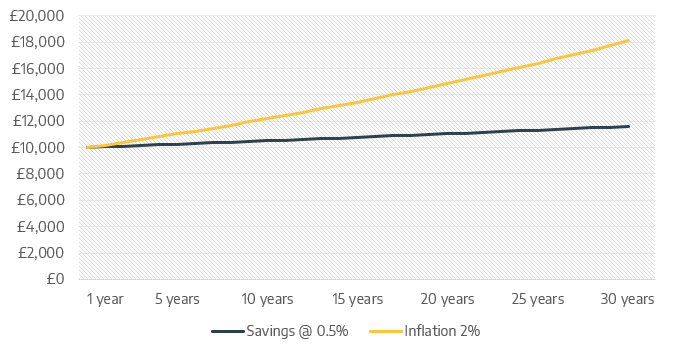

Another way to look at it is by way of trying to keep up with inflation by saving at sub-inflation rates

4 timeless ways to stay ahead of inflation

Although there are many ways, we look at some common ones that are appropriate for most investors.

Certain asset classes typically provide above inflation returns in the long-term. Couple of examples are equities and bonds (typically high-yield and corporate bonds). Exposure to these asset classes is also commonly available in the form of investment vehicles such as funds.

Risk and returns are directly proportional. The more risk you take, higher returns can be expected from your investments and investing for long-term can help smoothen out the effects of volatility.

Investing via tax wrappers is a wise choice. Currently, Individual Savings Accounts (ISAs) and pensions are efficient tax wrappers that shield your capital gains and dividends from taxes. Consequentially, this allows your investments to grow tax-free and help outpace inflation.

A professional adviser could help to create an investment strategy so that it works towards achieving your objectives within a given level of risk. Such a strategy could also benefit from the advantages of diversification and tax efficient investing.