Stocks and Shares ISA

A Stocks and Shares ISA helps your investments grow tax free and with no tax liability on income and gains, it is certainly a wise option to minimise and save taxes.

This insight also attempts to answer the following questions: -

What is Stocks and Shares ISA?

What are the benefits of Stocks and Shares ISA?

Who can open Stocks and Shares ISA?

Can I have a joint ISA?

What is the difference between Cash and a Stocks and Shares ISA?

Hows does Stocks and Shares save tax?

What is Stocks and Shares ISA?

A Stocks and Shares ISA is an Individual Savings Account through which you invest in Stocks, Bonds, Funds, Investment Trusts, and also hold cash. Each tax year (starting from 6th April), you can invest up to £20,000 into Stocks and Shares ISA.

You could either look to invest for growing your investments in the future or draw income from them.

What are the benefits of Stocks and Shares ISA?

Investments in your Stocks and Shares ISA grow tax free. This means when you sell your investments, you don't pay capital gains tax. You also do not pay any dividend tax when you receive dividends from your investments. It is the most tax efficient way to shield upto £20,000 worth of your investments every tax year.

Who can open a Stocks and Shares ISA

You can open a Stocks and Shares ISA if: -

- You are at least 18 years old and a UK resident for tax purposes

- You haven't already paid into another Stocks and Shares ISA in the current tax year

- You have not exceeded the annual ISA allowance of £20,000

Can I have a joint Stocks and Shares ISA?

No, as the name implies; Individual Savings Account is only per individual. It cannot be held in joint names.

What is the difference between Cash and a Stocks and Shares ISA?

A Cash ISA only allows you to hold cash. You cannot purchase any investments from the cash you hold in the account and the cash earns an interest. Whilst a Stocks and Shares ISA can also hold cash, you can purchase investments from this cash.

What is the difference between Cash and a Stocks and Shares ISA?

A Cash ISA only allows you to hold cash. You cannot purchase any investments from the cash you hold in the account and the cash earns an interest. Whilst a Stocks and Shares ISA can also hold cash, you can purchase investments from this cash.

How does Stocks and Shares save tax?

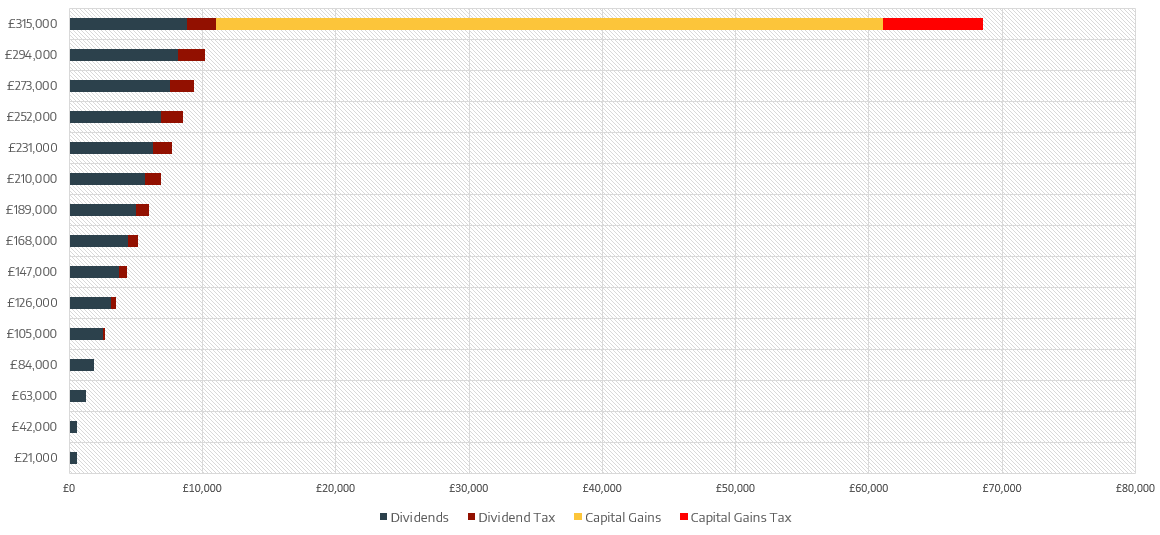

To better understand this, take a look at what happens when you do not use a Stocks and Shares ISA to invest. The chart assumes an annual contribution of £20,000 into a non-ISA Investment Account, 5% annual return on investments and previous years' investments earn dividend @3%. As your investment grows (y-axis) and once you start earning dividend over your annual dividend allowance of £2,000, you start paying dividend tax. And once you sell your investments at the end of 15 years, you pay a hefty capital gains tax assuming you make £50,000 in gains.

This example assumes you are a higher rate tax payer and have a dividend tax rate of 20%.

Please note all figures used above are hypothetical and for illustration purposes only and not based on actual returns; the actual return rate may vary. Tax laws could change the way dividends and capital gains are taxed.